Accelerate the costing of your complex products and increase your sales!

You are experiencing difficulties:

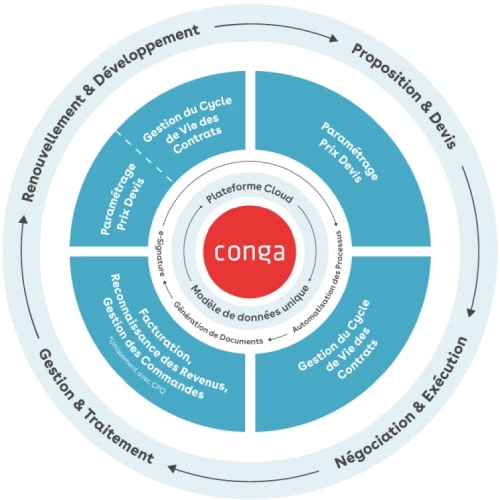

We help you choose and implement simple, effective solutions to improve your internal processes and accelerate your revenue life cycle.

How?

We make your sales management processes more reliable: from quotation generation to invoicing.

The quote-to-cash process refers to all the applications used to manage customer interactions, from pricing and invoicing to purchasing and revenue recognition. It is generally associated with the integration of customer relationship management (CRM) and enterprise resource planning (ERP)/finance systems to optimize returns on investment. When combined with Configure Price Quote (CPQ) systems, QTC is particularly useful for complex products or services requiring specific configuration.

This process aims to transform business opportunities into profitable, lasting and, ideally, repeat customer relationships.

Suggesting the right combination of products and services to meet customer needs.

Offer the right mix of discounts, promotions and incentives to win customers – without cutting margins.

Create sales proposals that are reliable, fast and in line with customer expectations.

Creation of secure contracts with details and conditions transmitted to the various parties involved, in particular the legal department.

Any changes to contract terms and clauses are automatically forwarded to the legal teams.

Necessary approvals obtained using an electronic signature tool.

System automation to ERP to ensure compliance with agreed contractual conditions.

Send for invoicing to guarantee payment deadlines, record payment and initiate any renewals.

Accurate and compliant receipt and accounting of income.

Building customer loyalty – encouraging recurring revenues – up-selling and cross-selling in anticipation of the end of a contract.

“Every organization needs to focus on cash flow to maintain a strong financial position and maximize profitability and liquidity. In service-oriented organizations, this process begins with a customer quote and ends once payment has been received and credited to their bank account. This macro-process of converting business opportunities into lucrative customer engagements is often referred to as “quote-to-cash”, and optimizing it is essential for financial strength.”

As Service Performance Insight points out in its Professional Services Maturity™ Benchmark 2021 study

Tailor your documents and processes to the way your organization works, and you’ll increase efficiency, reduce lost revenue and improve overall compliance.

Having a Quote-to-Cash solution is a major growth lever, because automating management from quotation to collection secures the entire end-to-end sales lifecycle.

Our consulting firm is made up of a team of consultants with significant experience in the deployment of Quote-to-Cash solutions. We support you throughout the integration project, to ensure that you achieve your objectives in terms of sales, productivity and operational efficiency.

We have selected the most powerful solutions on the market to deliver an outstanding customer experience while securing the overall sales lifecycle.

Answers from an expert in Quote-to-Cash solutions

Welcome to our FAQ section dedicated to Quote-to-Cash solutions. Here you’ll find answers to the most frequently asked questions about the life cycle from configuration to collection and renewal.

Contract Lifecycle Management (CLM) and Quote-to-Cash (QTC) are two terms used in the field of contract and sales management.

CLM – Contract LifeCycle Management – refers to theentire contract management process, from creation to negotiation, from signature to management of obligations and renewals. CLM enables companies to effectively manage their contracts throughout their lifecycle, reducing risk and maximizing contract value.

QTC refers to theentire sales process, from the creation of quotations (or sales proposals) to the collection of payments. QTC covers the entire sales cycle, from customer contact through order and inventory management to delivery and invoicing.

So, although the two processes share common ground in that they manage key elements of the sales lifecycle, CLM focuses specifically on contract management, while QTC covers theentire sales process.

The quote-to-cash process is applied and governed by several teams, such as the sales department, the delivery team and the finance department. And while each team has a specific role and function, such as the finance team, responsible for accounts receivable and sales management, all departments need to combine their expertise and work together efficiently and collaboratively.

With a Quote-to-cash solution, all the independent actions that make up the management cycle are managed easily and transparently for all parties involved.

This enables vendors to efficiently provide accurate information to customers, minimize order and billing errors, and improve data analysis and forecasting.

A Quote-to-Cash solution helps reduce errors and delays in several ways:

QTC speeds up payment and improves cash flow thanks to several factors:

Read more